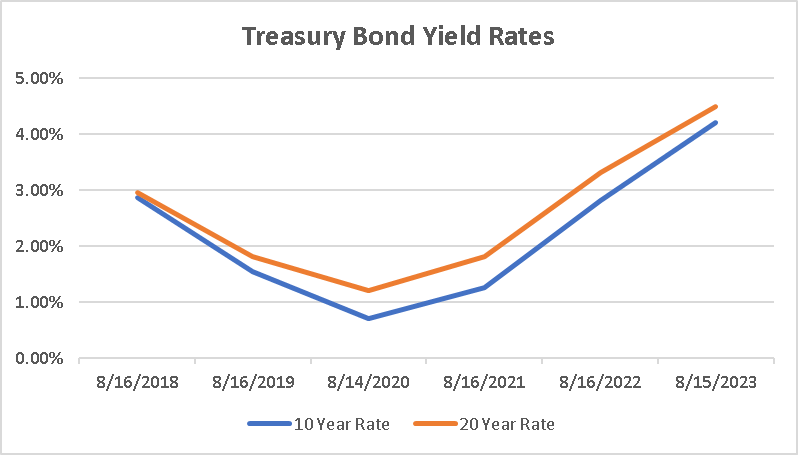

Have you seen the bank advertisements looking to lure account holders to open short-term CDs at 4.5% or 4.9%? You may have read this article in the Wall Street Journal tracking the increasing treasury bill rates over the past few months. Where is this coming from, and how will this recent increase in Treasury Yield rates impact the valuations of closely held businesses?

Figure 1. Adapted from Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis. FRED | St. Louis Fed.

The short answer to this question: It may profoundly impact various aspects of the economy – including the valuations of closely held businesses.

The complex relationship between financial variables can reverberate across different sectors. We will delve into the mechanisms behind some of these interactions and explore how rising treasury yields can influence the valuation landscape of closely held businesses.

Treasury Yields 101

First, it’s essential to understand what treasury yields are and how they function. Treasury yields represent the expected return from investing in government bonds. This return is often called a “risk-free rate” since the government guarantees it. When yields rise, it generally indicates that the market demands higher compensation for lending money to the government due to factors like inflation and changes in monetary policy.

Discount Rate And Present Value

An increase in treasury yields directly affects the computation of the discount rate and, in turn, affects the valuation of closely held businesses. In business valuation, the discount rate is used to compute the present value of future cash flows. As treasury yields rise, the discount rate also tends to increase, thus impacting the determination of value.

All things being equal, applying a higher discount rate results in a lower present value. This can potentially lead to downward valuation computations. Investors and buyers become more cautious as the treasury yields rise, making riskier investments, like closely held businesses, less appealing.

Risk Tolerance In Business Valuations

Closely held businesses inherently carry a higher risk level than other investments, particularly when compared to publicly owned companies. With increasing treasury yields, the risk-free rate of return becomes more attractive, which can shift investor preferences. This shift in risk perception can influence the demand for closely held businesses and impact their valuations.

Investors may reassess their expectations of returns and the risk associated with investing in closely held businesses compared to more attractive treasury yields. This recalibration of risk and reward can decrease valuation multiples for closely held businesses, as buyers may demand greater compensation for taking on business-specific risks.

How Do Changes in Treasury Yields Affect Interest Rates and Borrowing?

The relationship between increasing treasury yields and interest rates has always been closely monitored. When treasury yields rise, it becomes more expensive for businesses to borrow money. Higher interest rates can adversely affect closely held businesses by impacting their growth plans, ability to spend on capital expenditures, investment in research and development, and other financial and business opportunities. In total, the increase in the cost of borrowing may dampen revenue and earnings projections, which, in turn, may lower the business’s valuation.

Market Perception and Liquidity

Rising treasury yields can also affect market perception and liquidity. When interest rates increase, it is only natural that attentive investors consider shifting their portfolios to assets that provide safer returns, leading to a potential decrease in liquidity for closely held businesses.

Reduced liquidity can create challenges for business owners seeking to sell or raise capital. And when there are challenges, uncertainty, and market volatility are never far behind.

Industry-Specific Considerations

That said, no uniform impact can be expected from the increase in treasury yields. Due to their unique characteristics, specific industries might be more sensitive to interest rate changes. For instance, industries that are capital-intensive and rely heavily on debt financing might experience a more pronounced impact on valuations as interest rates rise.

However, industries with stable and or growing cash flows and less reliant on external financing might be insulated from the effects of rising treasury yields. Factors influencing business valuations depend on industry dynamics and the economic environment.

Some industries that may be more negatively impacted by an increase in treasury yields include:

- Real Estate: Higher interest rates can lead to higher mortgage rates, making it more expensive for consumers to buy homes. This can slow down the housing market and affect homebuilders, real estate developers, and related industries.

- Consumer Discretionary: Industries that rely on consumer spending, such as retail, entertainment, and travel, may face challenges as borrowing costs increase.

- Automotive: Higher interest rates can lead to more expensive auto loans, which can potentially dampen consumer demand for new cars.

- Construction: Increased borrowing costs can impact construction projects, both residential and commercial. Higher interest rates can lead to reduced demand for new construction and renovations.

- Utilities: Utility companies often have high levels of debt and relatively stable cash flows. An increase in interest rates can increase their borrowing costs and potentially impact their profitability.

The increase in treasury yields affects financial, economic, and psychological factors affecting closely held businesses’ valuation. As treasury yields rise, the adjustment of discount rates, risk perception, interest rates, and market sentiment collectively shape the valuation landscape for these businesses.

It’s essential to recognize that the impact of increasing treasury yields on closely held business valuations is not a one-size-fits-all scenario. Different industries and businesses will experience varying degrees of influence based on their specific characteristics and market conditions. Ultimately, business owners, including investors, must consider these factors and their potential consequences when assessing the impact of rising treasury yields on the valuations of closely held businesses.

To understand how MSGCPA can assist lawyers and their clients in managing the impact of increasing treasury yields on their business valuations, schedule a 15-minute call with Mark S. Gottlieb, CPA/ABV/CFF, ASA, CVA, CBA, MST.

Read More Blogs on Business Valuation: