When representing a client with a business valuation report in hand, attorneys must look beyond the numbers at face value. Though you often leave the financial modeling and technical details to the valuation experts, a keen understanding of valuation inputs remains imperative for attorneys on either side of a transaction or dispute.

The capitalization rate (a.k.a. the “cap rate”) is among the most impactful business valuation inputs. This factor warrants particular scrutiny, as variations of even 0.5 percent can alter the valuations significantly. Properly vetting this input is essential to achieve an accurate valuation that stands up to legal scrutiny.

To add another instrument to your toolbelt, we will provide a quick primer on the cap rate and its components.

What is the Capitalization Rate?

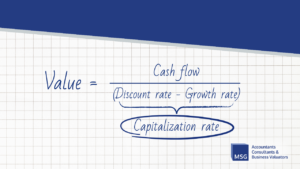

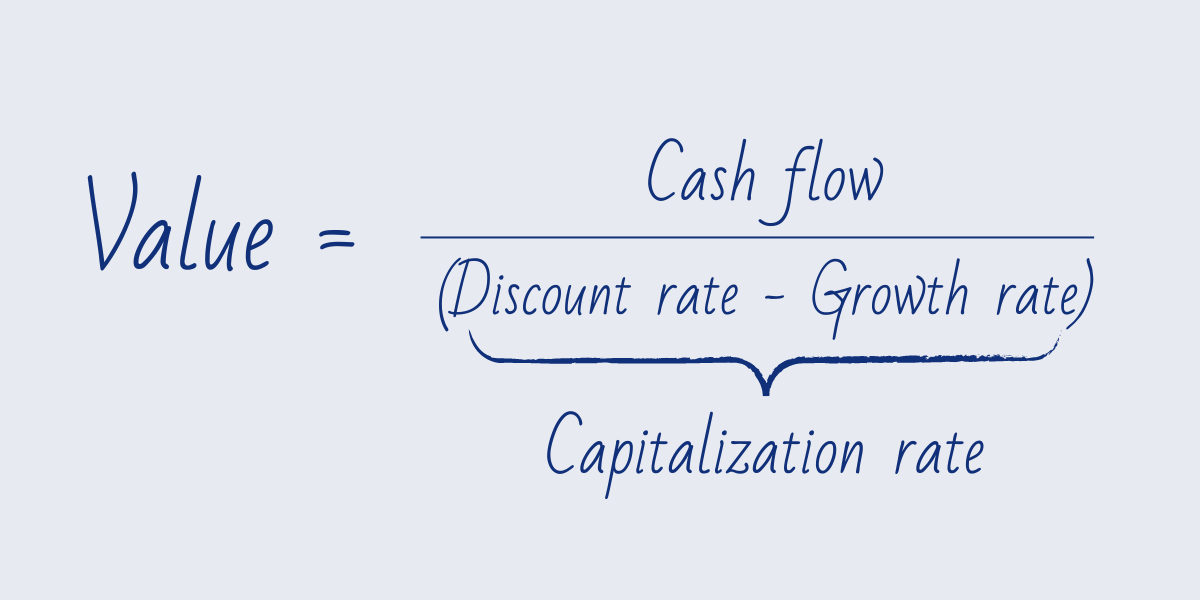

The capitalization rate is the rate of return used to convert a business’s annual earnings or cash flows into an initial company value, accounting for risk and growth prospects.

Discount Rate

The discount rate is the annual rate used to convert projected future cash flows into present value, reflecting the riskiness, time value of money, and required rate of return an investor would expect on the investment.

The most common components used when computing the discount rate are:

- Risk-free rate of return

- Equity risk premium

- Size Premium, and

- Company-specific risk premium

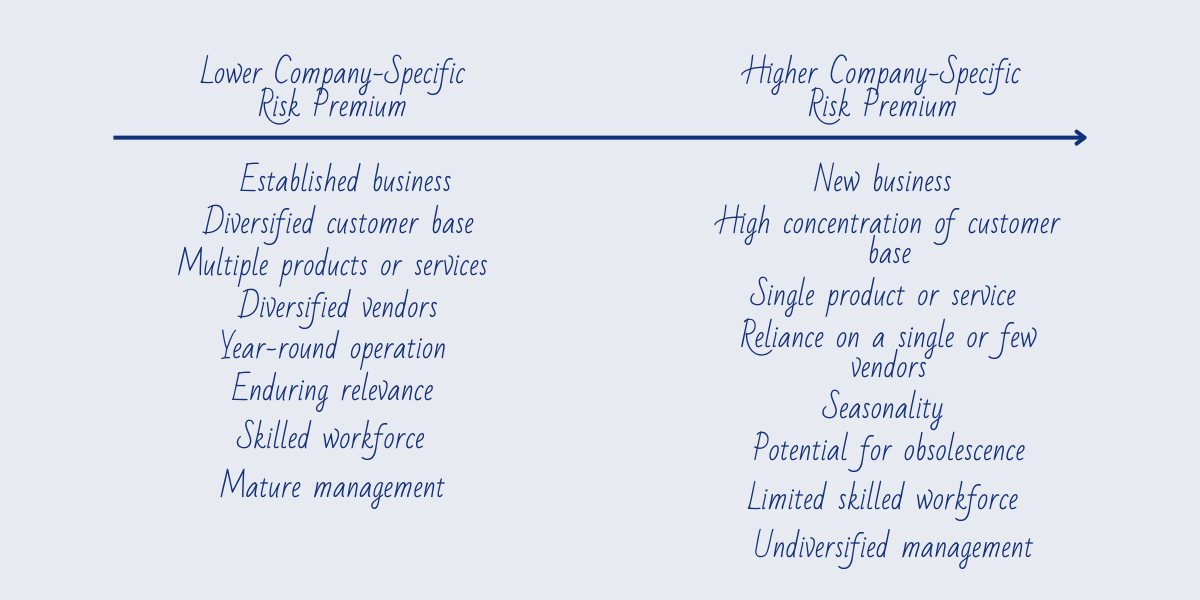

Generally, empirical evidence of the marketplace can ascertain the first three components. However, the fourth component, company-specific risk premium, is subjective and often the subject of debate.

There is no objective source of data to reflect or quantify the company-specific risk premium properly. It’s a matter of both judgment and experience of the business valuation expert.

Below are some factors that influence the company-specific risk premium.

Notably, a lower company-specific risk premium tends to result in a higher valuation, and conversely, a higher premium leads to a lower result. The valuation expert’s ability to articulate the pros and cons of the company’s industry, business, and financial components becomes integral to the valuation report.

Growth Rate

Growth rates are equally critical. This refers to the expected rate at which a company’s earnings, cash flows, or other relevant financial metrics are anticipated to grow over a specific period. The long-term growth rate aims explicitly to capture the sustainable annual growth anticipated by the company.

I have seen, historically, that many valuation experts choose a growth rate that would not be reasonably sustainable for the long term. Typically, this prediction relies on a long-term inflation factor, with minor adjustments of a few percentage points in either direction.

By focusing on the cap rate and its influencing factors, attorneys can better assess the credibility of a valuation opinion in litigation. The ability to dissect the valuation expert’s choices and reasoning behind assumptions regarding risk and growth adds a strategic advantage in articulating or discrediting the valuation results.

To discuss your case further, schedule a call with our team leader, Mark S. Gottlieb, CPA/ABV/CFF, ASA, CVA, CBA, MST, click here.