Remember the case of Enron in 2001? Their reported revenues of over $100 billion ended up being a fiction. But fraud isn’t limited to the corporate world. In September 2014, Matthew Wada and Jennifer York were indicted on fraud charges for renting out occupied apartments, cheating victims out of more than $60,000.

Remember the case of Enron in 2001? Their reported revenues of over $100 billion ended up being a fiction. But fraud isn’t limited to the corporate world. In September 2014, Matthew Wada and Jennifer York were indicted on fraud charges for renting out occupied apartments, cheating victims out of more than $60,000.

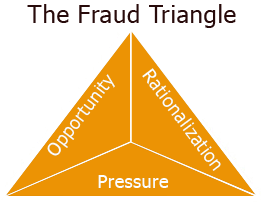

Whatever the intensity or scope of a fraudulent activity, the elements behind a person’s decision to commit fraud remain universal. Forensic accountants utilize the Fraud Triangle as the standard tool in their investigation of fraudulent activities.

Researchers Edwin Sutherland and Donald Cressey provided the seeds of the Fraud Triangle. Cressey extended Sutherland’s ideas behind “Differential Association” (which analyzed why people commit crimes), pinning down three elements which must be present for embezzlement to occur:

- A non-sharable problem,

- An opportunity for trust violation, and

- A set of rationalizations that define the behavior as appropriate.

However, it wasn’t until a 1979 study that the variables leading to fraud were directly investigated. These researchers refined and broadened Cressey’s three points further:

- Situational pressures,

- Opportunities to commit fraud, and

- Personal integrity (character).

These researchers also found that these aspects were interactive, showing that if more of one element is present, less of the other two are needed. This list would be later refined by one of the original co-authors, W. Steve Albrecht. He included perception into the elements, as well as finding that a return to one of Cressey’s original points was a better fit. He came up with the final sides of the triangle:

- Perceived Pressure,

- Perceived Opportunity, and

- Rationalization.

Perceived Pressure

People often feel they are being forced into the actions they take, regardless whether these actions exist in reality, or are simply a matter of perception. In the instance of fraud, these pressures can come in the form of an enormous amount of real debt, or the perceived threat of a possible divorce.

Perceived Opportunity

In many fraud cases people wonder, “Why did they think they could get away with it?” The reason behind this is that, like pressure, the opportunities to commit fraud can also be simply perceived rather than real. If someone feels both pressured and can rationalize fraud, it is not too hard for them to create an available opportunity.

Rationalization

Perhaps the most easily to recognize is rationalization. We have seen it in the news, in movies, and in books: the person about to commit a crime, or in the midst of committing one, rationalizes their action. This ability to rationalize an action which would normally go against one’s moral code must also be present.

According to the global survey by the Association of Certified Fraud Examiners (ACFE), the typical organization loses at least 5% of revenues each year to fraud. Globally this amounts to over $3 trillion dollars lost to fraud. While it is hard for a company to control the pressure or the rationalization sides of the triangle, the opportunity side can be. Some steps they can take are:

- Regular risk assessments,

- Frequent staff training and evaluations,

- Create a fraud reporting system within your organization,

- Use data mining to identify fraud “red flags,”

- Create manual checks and balances, and

- Consistent external audits.

As can be seen, the best way to detect fraud is to have a thorough system in place and to stay vigilant.

Fraud, sadly, occurs every day in many different spheres of business and life. However, tools such as the Fraud Triangle can help investigators of fraud, such as forensic accounting experts, analyze the causes behind potential fraud and bring any wrongdoing to light.

Please click here to instantly obtain a free copy of this whitepaper.