This has certainly been an eventful week. My beloved New York Mets were sold. Although I believe Steve Cohen will be up to the task, I am somewhat resentful that my bid to purchase the Amazins was rejected. On the other side of the plate, Joe Biden can claim victory in the turbulent presidential election. Despite the possible legal battle, it appears that the Biden-Harris battery is now warming up for a January 2021 inauguration.

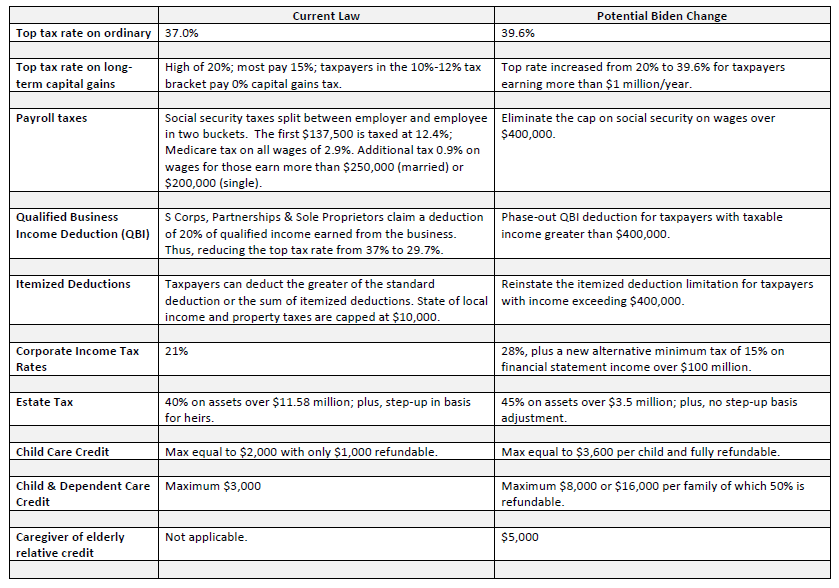

President-elect Biden has made no secret of his intent to raise $3.5 trillion in taxes over the next ten years. The intended contributors will be corporations and individuals earning over $400,000 per year. Conversely, lower-income taxpayers may benefit from tax-cutting incentives from items such as refundable credits, etc.

Biden’s ability to effectuate any tax change heavily depends upon the Democrats’ ability to win both the House and Senate. The Democrats currently hold a majority in the House of Representatives but are taking swings at the two remaining Senate seats up for grabs. If the Democrats sweep both available seats and get a 50/50 split in the Senate, then the Biden tax reform vision could theoretically be passed without a single Republican defector.

Pending a home-field advantage, the Biden tax reform could pass via a Budget Reconciliation which will not require 60 votes for passage. Alternatively, they will only need a majority of 51 votes. Assuming everyone votes along the party line, Vice President-elect Kamala Harris will cast the deciding vote.

Without the benefit of a formal lineup card, the expected Biden field will be set with potential sweeping changes to the existing Trump tax cuts of 2017. Here are a few that that Team Biden is considering:

Though its eventual success is by no means a guarantee, for now, it seems there is a feasible strategic pathway between the Biden administration and its desired tax reforms. Certainly President-elect Biden’s previous comments have made evident that regardless of the future Senatorial outcomes, he and his administration will swing for the fences to reform dividend income, capital gains, and estate income taxes.

By mid-April 2021 pitchers and catchers will report to camp and the Biden tax reform will be in play. We will have to wait until then to see who is throwing strikes.

There is still time to transfer your client’s business before any significant tax changes take effect. Perhaps your clients will be as lucky as the Mets’ owners to sell or transfer their business at the current low tax rates.

If you have any business valuation questions, please feel free to call our office.